Auxetic Metamaterials Manufacturing Industry Report 2025: In-Depth Analysis of Market Dynamics, Technology Innovations, and Growth Projections. Explore Key Trends, Regional Insights, and Strategic Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Auxetic Metamaterials

- Competitive Landscape and Leading Manufacturers

- Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

- Regional Market Analysis & Emerging Hotspots

- Future Outlook: Innovation, Investment, and Adoption Scenarios

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Auxetic metamaterials are a class of engineered materials characterized by a negative Poisson’s ratio, meaning they become thicker perpendicular to an applied force when stretched. This unique property imparts auxetic metamaterials with exceptional mechanical characteristics, such as enhanced energy absorption, superior fracture resistance, and improved indentation resilience. In 2025, the global auxetic metamaterials manufacturing market is positioned at the intersection of advanced materials science and high-value industrial applications, with significant momentum driven by innovation in fabrication techniques and expanding end-use sectors.

The market is witnessing robust growth, propelled by increasing demand from aerospace, defense, medical devices, and sports equipment industries. The aerospace and defense sectors, in particular, are leveraging auxetic structures for lightweight, impact-resistant components, while the medical field is exploring their use in prosthetics, stents, and orthopedic implants due to their conformability and durability. According to MarketsandMarkets, the global auxetic metamaterials market is projected to grow at a CAGR exceeding 20% from 2023 to 2028, with the manufacturing segment accounting for a substantial share of this expansion.

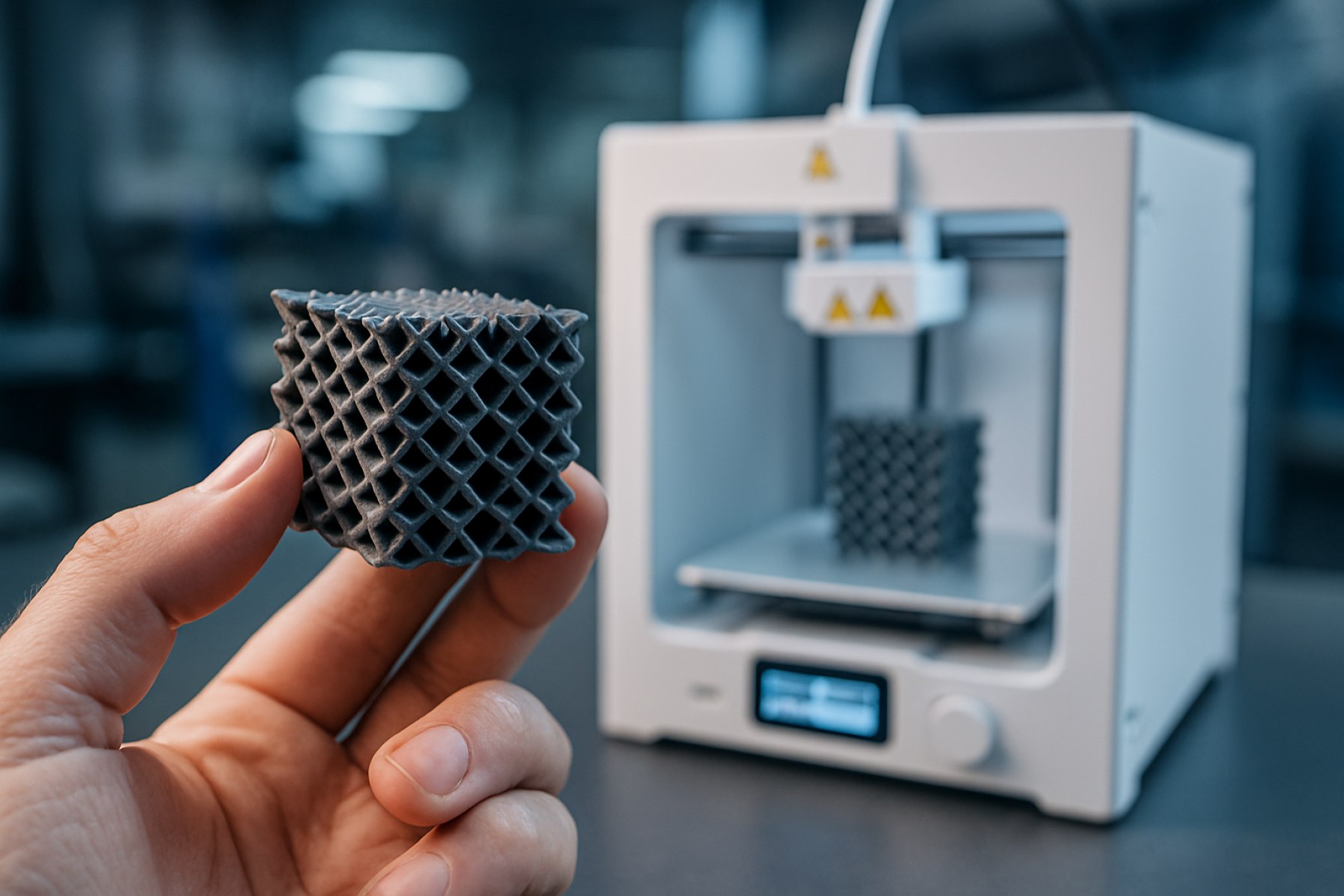

Technological advancements in additive manufacturing (3D printing) and microfabrication are central to the market’s evolution. These methods enable the precise and scalable production of complex auxetic geometries, which were previously challenging to fabricate using conventional techniques. Leading research institutions and companies, such as Massachusetts Institute of Technology (MIT) and Oxford Metamaterials, are at the forefront of developing scalable manufacturing processes and commercializing auxetic products.

Geographically, North America and Europe dominate the auxetic metamaterials manufacturing landscape, supported by strong R&D ecosystems and early adoption in high-tech industries. However, Asia-Pacific is emerging as a significant growth region, driven by increased investments in advanced manufacturing and materials innovation, particularly in China, Japan, and South Korea.

Key challenges for the industry include high production costs, scalability issues, and the need for standardized testing protocols. Nevertheless, ongoing research and collaborative efforts between academia and industry are expected to address these barriers, paving the way for broader commercialization and integration of auxetic metamaterials across diverse applications in 2025 and beyond.

Key Technology Trends in Auxetic Metamaterials

Auxetic metamaterials, characterized by their negative Poisson’s ratio, are gaining traction across industries due to their unique mechanical properties. In 2025, manufacturing technologies for auxetic metamaterials are evolving rapidly, driven by the need for scalability, precision, and integration with advanced materials. The following key trends are shaping the manufacturing landscape:

- Advanced Additive Manufacturing (AM): Additive manufacturing, particularly high-resolution 3D printing, remains at the forefront of auxetic metamaterial production. Techniques such as stereolithography (SLA), selective laser sintering (SLS), and direct ink writing (DIW) enable the fabrication of complex, re-entrant, and chiral geometries at micro- and nano-scales. The adoption of multi-material 3D printing is also allowing for the integration of auxetic structures with functional materials, enhancing performance in applications like flexible electronics and biomedical devices (Nature Reviews Materials).

- Roll-to-Roll and Continuous Processing: For large-scale production, roll-to-roll (R2R) manufacturing is emerging as a viable method, especially for polymer-based auxetic films and foams. This approach supports high-throughput fabrication and is being adopted for applications in protective textiles and filtration membranes (Materials Today).

- Microfabrication and Lithography: Microelectromechanical systems (MEMS) fabrication techniques, including photolithography and soft lithography, are enabling the production of auxetic metamaterials with sub-micron precision. These methods are particularly relevant for the electronics and medical device sectors, where miniaturization and integration are critical (MDPI Polymers).

- Material Innovations: The development of new polymers, composites, and hybrid materials is expanding the design space for auxetic metamaterials. Researchers are leveraging nanomaterials such as graphene and carbon nanotubes to impart additional functionalities, including electrical conductivity and enhanced mechanical strength (Nano Energy).

- Digital Design and Simulation: The integration of computational design tools and machine learning algorithms is accelerating the optimization of auxetic architectures for manufacturability and performance. Digital twins and generative design are being used to predict mechanical behavior and streamline the transition from prototype to mass production (Elsevier).

These manufacturing advancements are expected to drive down costs, improve scalability, and open new commercial opportunities for auxetic metamaterials in 2025 and beyond.

Competitive Landscape and Leading Manufacturers

The competitive landscape of auxetic metamaterials manufacturing in 2025 is characterized by a blend of established advanced materials companies, innovative startups, and research-driven collaborations. The market remains relatively nascent but is experiencing rapid growth due to increasing demand from sectors such as aerospace, defense, medical devices, and sports equipment. Key players are leveraging proprietary fabrication techniques, intellectual property portfolios, and strategic partnerships to gain a competitive edge.

Leading manufacturers include 3D Systems Corporation, which utilizes advanced additive manufacturing to produce customized auxetic structures for medical and industrial applications. Stratasys Ltd. is also prominent, offering multi-material 3D printing platforms that enable the precise fabrication of complex auxetic geometries. In Europe, Evonik Industries AG has invested in R&D for polymer-based auxetic foams and films, targeting automotive and protective gear markets.

Startups such as Meta Materials Inc. are pushing the boundaries with novel design algorithms and scalable production methods, focusing on lightweight, high-strength auxetic composites for aerospace and energy sectors. Meanwhile, Oxford PV and other university spin-offs are commercializing research breakthroughs, particularly in the biomedical field, where auxetic stents and implants are gaining traction.

The competitive environment is further shaped by collaborations between manufacturers and research institutions. For example, Airbus has partnered with academic labs to integrate auxetic metamaterials into next-generation aircraft components, aiming for enhanced impact resistance and weight reduction. Similarly, Boeing is exploring auxetic structures for improved vibration damping and noise reduction in aerospace interiors.

- Key competitive factors include proprietary design software, material innovation, and the ability to scale production while maintaining quality and performance consistency.

- Intellectual property rights and patents play a significant role, with leading firms aggressively protecting novel auxetic architectures and manufacturing processes.

- Geographically, North America and Europe dominate the market, but Asia-Pacific manufacturers are rapidly increasing their presence, particularly in high-volume, cost-sensitive applications.

Overall, the auxetic metamaterials manufacturing sector in 2025 is marked by dynamic competition, technological innovation, and a growing emphasis on application-specific solutions, positioning it for continued expansion as end-user industries recognize the unique advantages of auxetic structures.

Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

The global auxetic metamaterials manufacturing market is poised for significant expansion between 2025 and 2030, driven by increasing demand across sectors such as aerospace, defense, medical devices, and advanced textiles. Auxetic metamaterials, characterized by their negative Poisson’s ratio, offer unique mechanical properties—such as enhanced energy absorption and fracture resistance—that are fueling their adoption in high-performance applications.

According to projections by MarketsandMarkets, the auxetic metamaterials market is expected to reach a valuation of approximately USD 1.2 billion by 2030, up from an estimated USD 350 million in 2025. This represents a robust compound annual growth rate (CAGR) of around 27% during the forecast period. The rapid growth is attributed to ongoing advancements in additive manufacturing and 3D printing technologies, which are enabling scalable and cost-effective production of complex auxetic structures.

Regionally, North America is anticipated to maintain its dominance in the auxetic metamaterials manufacturing landscape, supported by substantial investments in R&D and the presence of leading aerospace and defense manufacturers. Europe is also expected to witness accelerated growth, particularly in the automotive and medical device sectors, as regulatory bodies encourage the adoption of innovative materials for safety and performance enhancements. Meanwhile, the Asia-Pacific region is emerging as a high-growth market, propelled by expanding manufacturing capabilities and increased government funding for advanced materials research in countries such as China, Japan, and South Korea.

Key market drivers include the integration of auxetic metamaterials in lightweight armor, impact-resistant packaging, and next-generation wearable devices. The medical sector, in particular, is projected to see a CAGR exceeding 30% as auxetic structures are increasingly utilized in prosthetics, stents, and orthopedic implants for their superior conformability and durability. However, challenges such as high initial production costs and the need for specialized fabrication techniques may temper the pace of market penetration in certain segments.

Overall, the auxetic metamaterials manufacturing market is set for dynamic growth through 2030, underpinned by technological innovation, expanding application scope, and strategic collaborations among material scientists, manufacturers, and end-users. As commercialization accelerates, the market is expected to witness both increased competition and a surge in patent activity, further shaping its trajectory in the coming years (Grand View Research).

Regional Market Analysis & Emerging Hotspots

The regional landscape for auxetic metamaterials manufacturing in 2025 is characterized by a dynamic interplay of established research hubs, emerging industrial clusters, and strategic government investments. North America, particularly the United States, continues to lead in both research output and early-stage commercialization, driven by robust funding from agencies such as the National Science Foundation and strong collaborations between universities and advanced manufacturing firms. The presence of major aerospace and defense contractors, such as Lockheed Martin and Boeing, has accelerated the integration of auxetic metamaterials into high-performance applications, including impact-resistant components and lightweight structures.

Europe remains a significant player, with Germany, the United Kingdom, and the Netherlands at the forefront. The European Union’s Horizon Europe program has allocated substantial funding for advanced materials research, fostering cross-border consortia and pilot manufacturing lines. Notably, the Eindhoven University of Technology and Imperial College London have established dedicated centers for metamaterials innovation, supporting both academic breakthroughs and industrial scale-up. The region’s focus on sustainability and circular economy principles is also shaping the development of recyclable and energy-efficient auxetic materials.

Asia-Pacific is emerging as a hotspot, with China and South Korea making significant strides in scaling up production capabilities. Chinese manufacturers, supported by the Ministry of Science and Technology of the People’s Republic of China, are rapidly moving from laboratory prototypes to commercial-scale manufacturing, particularly for applications in flexible electronics and medical devices. South Korea’s emphasis on smart manufacturing and its strong electronics sector, led by companies like Samsung Electronics, is fostering innovation in auxetic structures for next-generation wearables and sensors.

- Emerging Hotspots: India and Singapore are gaining traction as new centers for auxetic metamaterials R&D, leveraging government-backed innovation hubs and partnerships with global firms.

- Key Trends: Regional clusters are forming around advanced manufacturing parks, with a focus on additive manufacturing and digital design tools to enable rapid prototyping and customization.

- Investment Patterns: Venture capital and public-private partnerships are increasingly targeting startups specializing in scalable auxetic manufacturing processes, particularly in Europe and Asia-Pacific.

Overall, the global auxetic metamaterials manufacturing market in 2025 is marked by regional specialization, with North America and Europe leading in high-value applications and Asia-Pacific driving cost-effective scale-up and diversification into consumer markets.

Future Outlook: Innovation, Investment, and Adoption Scenarios

The future outlook for auxetic metamaterials manufacturing in 2025 is shaped by accelerating innovation, increasing investment, and expanding adoption across multiple industries. Auxetic metamaterials—engineered structures that exhibit a negative Poisson’s ratio—are gaining traction due to their unique mechanical properties, such as enhanced energy absorption, superior fracture resistance, and tunable deformation characteristics. These features are driving research and commercial interest, particularly in sectors like aerospace, defense, medical devices, and sports equipment.

Innovation in 2025 is expected to be propelled by advances in additive manufacturing (AM) and digital design tools. The integration of AI-driven topology optimization and multi-material 3D printing is enabling the fabrication of complex auxetic geometries at scale, which was previously unattainable with traditional manufacturing methods. Companies such as Stratasys and 3D Systems are investing in R&D to refine AM processes for auxetic structures, focusing on improving material performance, production speed, and cost efficiency.

Investment trends indicate a growing influx of capital from both public and private sources. Government agencies, including the Defense Advanced Research Projects Agency (DARPA) and the European Commission, are funding projects aimed at developing next-generation protective gear and lightweight structural components using auxetic metamaterials. Venture capital activity is also rising, with startups targeting niche applications such as flexible electronics and advanced filtration systems.

Adoption scenarios for 2025 suggest a transition from prototyping to early-stage commercialization. Aerospace and defense are anticipated to be early adopters, leveraging auxetic materials for impact-resistant panels and morphing structures. The medical sector is exploring auxetic stents, prosthetics, and orthopedic implants, with clinical trials and regulatory approvals expected to accelerate market entry. Consumer goods manufacturers are piloting auxetic foams and textiles for enhanced comfort and durability in footwear and protective apparel.

- By 2025, the global auxetic metamaterials market is projected to reach $100–150 million, with a CAGR exceeding 20% according to MarketsandMarkets and IDTechEx.

- Key challenges remain in scaling up production, ensuring material consistency, and reducing costs, but ongoing innovation and investment are expected to address these barriers.

- Collaborative efforts between academia, industry, and government will be crucial in standardizing manufacturing processes and accelerating adoption.

Challenges, Risks, and Strategic Opportunities

The manufacturing of auxetic metamaterials in 2025 faces a complex landscape of challenges, risks, and strategic opportunities. Auxetic metamaterials, characterized by their negative Poisson’s ratio, offer unique mechanical properties such as enhanced energy absorption and fracture resistance. However, scaling their production from laboratory prototypes to commercial volumes remains a significant hurdle.

One of the primary challenges is the precision required in fabrication. Auxetic structures often rely on intricate geometries at the micro- or nano-scale, necessitating advanced manufacturing techniques such as additive manufacturing, laser sintering, or micro-molding. These processes can be cost-prohibitive and time-consuming, especially when aiming for high throughput and consistent quality. According to IDTechEx, the high cost of specialized 3D printing materials and equipment remains a barrier to widespread adoption in industrial applications.

Material selection also presents risks. Many auxetic designs require polymers or composites with specific mechanical properties, and not all materials are compatible with existing manufacturing platforms. This can limit scalability and increase supply chain complexity. Furthermore, quality assurance is a persistent issue, as minor defects in the structure can significantly impact performance, necessitating rigorous inspection protocols and advanced metrology tools.

Despite these challenges, strategic opportunities are emerging. The growing demand for lightweight, impact-resistant materials in sectors such as aerospace, automotive, and medical devices is driving investment in auxetic metamaterials. Companies that can develop cost-effective, scalable manufacturing processes stand to gain a competitive advantage. For example, partnerships between material suppliers and end-users are fostering innovation in process optimization and material formulation, as highlighted by McKinsey & Company.

- Adoption of digital manufacturing and AI-driven process control can enhance yield and reduce costs.

- Vertical integration of material development and component fabrication may streamline supply chains.

- Collaborative R&D initiatives, supported by government grants and industry consortia, are accelerating the transition from prototype to production.

In summary, while the manufacturing of auxetic metamaterials in 2025 is fraught with technical and economic challenges, companies that strategically invest in advanced manufacturing technologies and collaborative innovation are well-positioned to capitalize on the growing market demand.

Sources & References

- MarketsandMarkets

- Massachusetts Institute of Technology (MIT)

- Nature Reviews Materials

- Elsevier

- 3D Systems Corporation

- Stratasys Ltd.

- Evonik Industries AG

- Meta Materials Inc.

- Oxford PV

- Airbus

- Boeing

- Grand View Research

- National Science Foundation

- Lockheed Martin

- Eindhoven University of Technology

- Imperial College London

- Ministry of Science and Technology of the People’s Republic of China

- Defense Advanced Research Projects Agency (DARPA)

- European Commission

- IDTechEx

- McKinsey & Company